While you can add cloud access to QuickBooks Enterprise, it involves an additional fee. Cassie is a deputy editor collaborating with teams around the world while living in the beautiful hills of Kentucky. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager. Katherine Haan is a small business owner with nearly two decades of experience helping other business owners increase their incomes. Another notable difference is QuickBooks Online offers a Self-Employed version for $15 per month, which is not available with QuickBooks Desktop. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

- Ideally, there will be a wizard to walk the user through the import process.

- It offers four plans ranging from $30 to $200 monthly, depending on the number of users and features you need.

- QuickBooks Online is great for most businesses, especially those that need inventory and project accounting and companies wanting to track activity by class and location.

- Problems stem from the complexity of making simple fixes, such as miscategorizations or duplicate entries.

- Advanced Pricing / Control , customize, and automate pricing is included in the Platinum and Diamond subscriptions only.

Compare QuickBooks products

If you didn’t receive an email don’t forgot to check your spam folder, otherwise contact support. You can learn QuickBooks even without an accounting background, but it becomes much easier to use if you have some knowledge of basic accounting concepts. Get all the functionality of basic reports plus the ability to run specific budgeting, inventory, and class reports. However you work, no matter what your business does, QuickBooks has a plan for you.

QuickBooks Solopreneur vs QuickBooks Simple Start

You’ll get the most value out of QuickBooks Online if you understand how to use its transaction tags and reporting capabilities. If you’re not sure whether you’re getting the most of these features, consider asking your accountant to review your chart of accounts and how you’re categorizing transactions. Though QuickBooks Online has a handful of convenient features that can speed up your workflow and even automate some of it, the software can be complex. You’ll get the most out of it if you have some knowledge of basic accounting concepts. Whereas you might be able to use some software alternatives without explanation, it may take some time to get the hang of QuickBooks.

Get all the tools you need to manage your business

QuickBooks Online Simple Start costs $30 per month, includes only one account user (plus access for two accountants) and does not offer billable hours tracking, bill pay or inventory management. For multiple users, bill pay and the ability to add billable hours to invoices, you’ll need to upgrade to the Essentials plan, which costs $60 per month. For inventory management, you’ll need to opt for the Plus plan at $90 per month.

How to Delete a Deposit in QuickBooks

In other words, if you never use them for payments, Wave is honest-to-goodness 100% free. And if you do use Wave for payments, well, that was a cost you https://www.business-accounting.net/gross-pay-vs-net-pay-gross-pay-vs-net-pay-whats/ were already going to have to incur regardless. One of the things that sets Zoho apart is its focus on meeting business needs at every stage of growth.

Manage everything—from cash flow and tax prep to inventory and entering time—all in one place.

If you report income on Schedule C of your personal income tax return, this cost-effective option might be best for you. Our research team has crunched the numbers, testing eight software brands across eight research subcategories to confirm that QuickBooks offers the best service with a top overall score of 4.7/5 points. QuickBooks has the best payroll software as well, although we offer a quick quiz that can pair you with all the top payroll options for your industry. If you’d like to try other great accounting software, we have you covered as well, with deals on FreshBooks, Xero, and others. We’d also highly recommend FreshBooks, a solution that has almost as many features and comes at a slightly lower price.

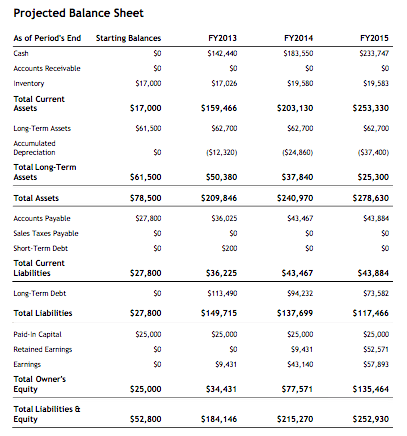

QuickBooks Online Advanced now offers a fixed asset accounting feature that allows you to enter and track fixed assets, such as vehicles, buildings, and equipment. Based on the depreciation method you choose, Advanced automatically calculates the depreciation for the fixed asset and creates a depreciation schedule. POs are essential because they help you specify what products and services you need from your vendor or supplier and by when you need them. When creating POs in Plus, you can input specific items you want to purchase. When your POs are fulfilled, you can convert them to a bill easily. Simple Start runs basic reports, including cash flow statements, profit and loss (P&L) statements, and balance sheets.

NetSuite is a cloud-based provider of comprehensive business solutions. Similar to Zoho, its offerings cover quite the spectrum — human capital, ERP, commerce and a host of other enterprise business buzzwords. While many digital solutions target small businesses, that’s a pretty wide umbrella on its own. FreshBooks is designed specifically for solopreneurs, small-business owners and self-employed accountants. It meets the needs of those with more straightforward accounting concerns, even if the clientele they serve faces complex financial use cases. This kind of accounting simplicity is often best for freelancers and soloprenuers in B2B office labor verticals like marketing, sales, IT — you get the idea.

QuickBooks Self-Employed tackles basic freelance bookkeeping features like expense tracking, receipt uploading, tax categorizing, quarterly tax estimating and mileage tracking. If you’re a freelancer, stick with its Self-Employed plan, which is $15 per month 9after the https://www.wave-accounting.net/ three-month discount at $7.50). Features include mileage tracking, basic reporting, income and expense tracking, capture and organize receipts and estimation of quarterly taxes. We went to user review websites to read first-hand reviews from actual software users.

With QuickBooks, small business owners have more time to spend running their business and managing all aspects of their business from invoicing, managing inventory, and paying bills right from QuickBooks. The Plus Plan is $45 per month for the first three months, then becomes $90 per month, and adds up to five users. It also has inventory management and gives you the ability to project profitability with forecasting reports. The Advanced Plan is the final tier for $100 per month for the first three months, then reverts to $200 per month. This allows more users (up to 25) and increases analytics for users to assess the business’s health.

By providing feedback on how we can improve, you can earn gift cards and get early access to new features. Bank-level security ensures your data is safe and accessible only to you and the people you choose to understanding credit cards share it with. Your account information is securely stored in the cloud and available anytime on all your devices. Match them to bills to stay organized and ready for tax season with everything in one place.

Previously, she was an editor at Fundera, where she developed service-driven content on topics such as business lending, software and insurance. She has also held editing roles at LearnVest, a personal finance startup, and its parent company, Northwestern Mutual. We believe everyone should be able to make financial decisions with confidence. On average, small business owners spend less than 30 minutes getting started in QuickBooks2. QuickBooks also offers unlimited support and access to free training, tutorials, and webinars.

We are committed to providing you with an unbiased, thorough, and comprehensive evaluation to help you find the right accounting software for your business. We meticulously and objectively assess each software based on a fixed set of criteria—including pricing, features, ease of use, and customer support—in our internal case study. Since QuickBooks Online is priced as a monthly subscription, it doesn’t require a contract and you can cancel your account at any time. Additionally, the desktop products are only available as annual subscriptions, making them a bigger commitment than QuickBooks Online. Through the QuickBooks app, you can snap receipts and upload expenses, which are then automatically sorted into tax categories for easier end-of-year tax deductions.

A lot of the features might not be relevant to you, such as payroll or managing 1099 contractors. However, the ability to send unlimited estimates and invoices and use advanced reporting can be crucial if freelancing is your full-time gig. As for inventory tracking, this feature is also available in the Plus plan. It sends you notifications when product levels are low and also lets you track the gross cost of goods. As far as the quality of customer support, QuickBooks Online users are split.

The plan offers up to three users all the features of QuickBooks Simple Start, plus the ability to track hours worked and manage bills. A key added feature of the QuickBooks Essentials plan is the ability to manage unpaid bills and allocate billable time and expenses to a specific customer. Additionally, QuickBooks Essentials will send reminders regarding upcoming bills to be paid so that you don’t miss a payment. QuickBooks is a well-established accounting software that is widely used by businesses from a variety of industries.